Geopolitical Risks May Be Biggest Threat to Global Markets, BoE Says

JPMorgan CEO Jamie Dimon says in September interview 'my caution is all geopolitics'

Geopolitical risks may be the biggest threat to global markets, the Bank of England (BoE) warned on Wednesday.

“Global vulnerabilities remain material, as does uncertainty around the geopolitical environment and global outlook,” the BoE said. "Markets remain susceptible to a sharp correction."

The BoE published its Financial Policy Committee Record for the third quarter of 2024 a day after Iran launched at least 180 ballistic missiles at Israel. The attack has raised fears of wider war in the Middle East with Tel Aviv likely to respond.

Concerns about an escalation in Mideast violence increased after Israel killed Hezbollah’s leader Hassan Nasrallah in airstrikes on September 27 in Beirut.

JPMorgan (NYSE:JPM) CEO Jamie Dimon warned on September 24 that there was “a lot of war taking place right now.”

“My caution is all geopolitics,” he said in an exclusive interview with CNBC TV18 at a JPM conference in Mumbai, India.

Global Markets React to Geopolitical Risks

European markets and global oil prices reacted quickly to the ballistic missile attack.

The Euro Area Stoxx 600 continued its retreat from its record high, trading flat today. Germany’s DAX40 pulled back from its record level, falling 0.55% today and continuing its 1.8% retreat from the record high of 19,473.

Brent crude oil rose 3.19% after the attack on Tuesday, reversing most of the September slump. But it hasn't increased as much as expected.

The World Bank said in April that if there was a severe disruption in oil supplies from the Middle East, Brent oil prices could surpass $100 per barrel.

“The geopolitically driven increases in oil prices continue this morning, with Brent trading above $75 a barrel,” Mohamed El-Erian, Queens’ College Cambridge president and Bloomberg Opinion columnist, said on X.

The escalation hasn’t led to significantly higher prices, “because there has been no actual disruption to oil production,” El-Erian wrote.

An escalation could also drive-up prices of natural gas, fertilizers, and food, the World Bank said at the time.

“So far no oil and gas facilities have been damaged and logistics for energy keep working as smoothly as possible,” Paul Sullivan, a Washington-based energy and Middle East expert and Lecturer at John Hopkins University, said in response to e-mailed questions.

“The risk premia for oil and oil transport could increase significantly if there is a directed attack on fields, pipelines, ports, ships and refineries,” he added.

Geopolitical Developments Worry ECB Officials

But European Central Bank (ECB) officials are concerned about the spike in geopolitical uncertainty.

A spike in energy prices could reverse the slowdown in inflation reported across much of Europe.

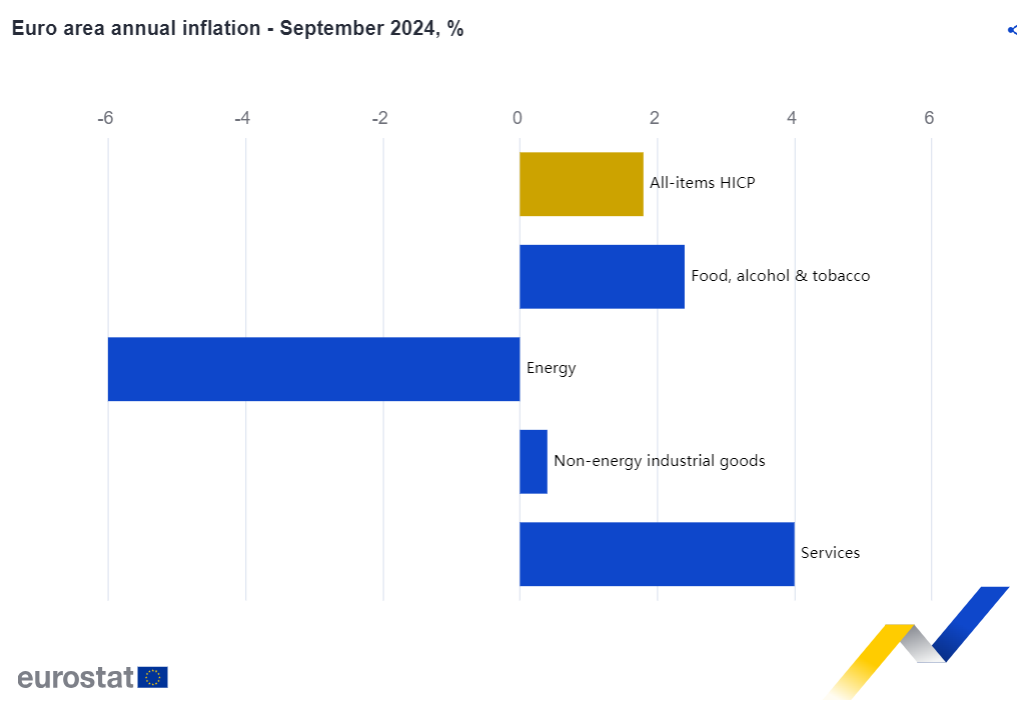

Euro area annual inflation slowed to 1.8% in September from 2.2% in August, the EU statistical office said on Tuesday.

“We are facing huge uncertainty – not least in view of the many prevailing economic, financial and geopolitical risks,” Luis de Guindos, Vice-President of the ECB, said the same day.

The ECB official was speaking at the 5th joint ECB, Bank of Canada and Federal Reserve Bank of New York Conference.

De Guindos said in a speech in Riga that the economic revival in the euro area is likely to gain momentum, though he warned that dangers remain.

He also warned that risks in the bloc are still “tilted to the downside.” He expressed optimism that faster growth could be achieved following a disappointing second quarter.

Geopolitical Uncertainty Main Risk

A BoE survey conducted in late July and early August echoed the prevailing concerns about geopolitical uncertainty.

The BoE found that 93% of the 55 banks and financial services firms that responded placed geopolitical risk as the biggest concern. That was the highest level recorded in the survey which goes back to 2008.

The “current period of elevated geopolitical risk and uncertainty” could place “further pressure on sovereign debt levels and borrowing costs, " the BoE said in its report today.

The UK's central bank pointed to “structural trends, such as demographics and climate change,” as factors that could undermine financial markets.

Sharp market corrections “could affect the cost and availability of credit to UK households and businesses,” it said.