Weekly Roundup: European Equities Soar on China, Inflation Data

Euro Area Stoxx 600, Germany’s DAX40 closed the week at record highs

European equities climbed during the week ending September 27 on China’s stimulus plans and slowing inflation, despite economic concerns persisting.

The Euro Area Stoxx 600 gained 2.69% in the week to a record, extending its year-to-date climb to 10.1%. Germany’s DAX40 closed the week at a record level, gaining 4% after increasing 1.22% on Friday.

Slow economic growth, volatile natural gas prices, and inflation have hurt European economic sentiment. GDP is projected to end 2024 at 0.8%.

Geopolitical concerns, including the war in Ukraine and the upcoming U.S. elections, have curbed European optimism. European policymakers have expressed concerns about issues from climate change, security and trade if Trump wins a second term.

Fears about a wider Middle East war escalated after Israel killed Hezbollah’s leader Hassan Nasrallah in airstrikes Friday in Beirut.

China’s ‘Stimulus Blitz

Despite these issues, investors welcomed the People’s Bank of China (PBOC) “stimulus blitz” to tackle the country’s economic headwinds.

China announced “a series of bold moves aimed at stabilizing both the economy and the stock market,” Charu Chanana, Head of FX Strategy at Saxo, wrote on September 25.

The package included a 50-basis-point cut to banks’ required reserve ratios (RRR) and a 20-basis-point cut to the seven-day reverse repurchase rate.

The PBOC announced a 500-billion-yuan ($71.3 billion) liquidity support for stock buybacks.

Fashion, Automobile Stocks See Most Gains

Although European equities rose immediately on the PBOC news, fashion and automobile stocks climbed the most.

France’s LVMH (OTCPK: LVMHF) jumped 19.2% ,and Hermes (OTCPK: HESAY) rose 16.5% for the week.

German automobile makers also clocked gains. Volkswagen (OTCPK: VWAGY) rose by 7%, Mercedes-Benz Group (OTCPK: MBGAF) by 6.55 and BMW (OTCPK: BMWYY) by 6.6%.

Germany’s automobile index rose 8.70% for the week.

European companies operating in China have worried that the slowdown in the world's second-largest economy may hurt profitability.

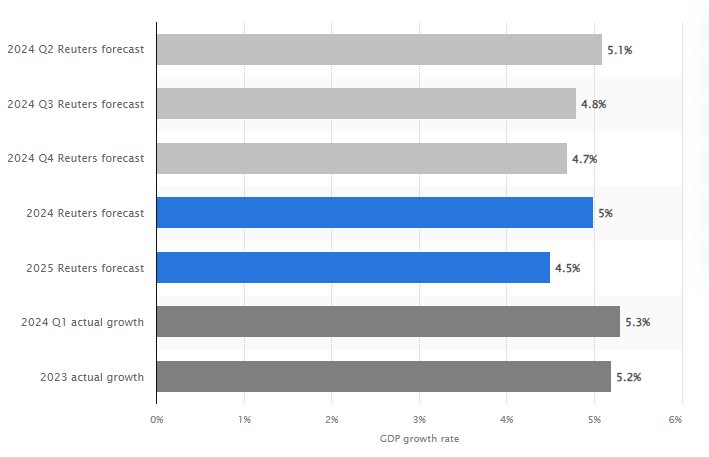

The Chinese economy grew 4.7% in the second quarter from April to June. This is the slowest pace since the first quarter of 2023 and below forecasts of 5% to 5.3%.

The stimulus package “can help to repair some of the confidence levels in the economy and policymakers,” Chanana wrote.

Helped by Inflation Data

European equities received an added boost this week from inflation data. France and Spain reported on September 27 that inflation slowed below 2%, beating analysts expectations.

Investors now give the European Central Bank (ECB) a 70% chance of cutting rates next month.

Investors give the European Central Bank (ECB) a 70% chance of cutting rates next month.

Although investors were buoyed by the latest economic data, others have been more cautious.

Data is “looking quite shaky,” Anwiti Bahuguna, Northern Trust Asset Management's chief investment officer of global allocation, told Bloomberg TV.

“Inflation is coming down, but not fast enough to think there would be very sharp relief on the rates front.”

European Consumer Sentiment Improves

Despite these concerns, European consumer sentiment has started to improve. It rose 0.5 points in the Euro Area in September to -12.9, which was in line with preliminary estimates.

“Consumers were markedly more optimistic about their households’ expected financial situation,” the European Commission said on September 27.

In Germany, France and Italy, Europe’s three largest economies, consumer confidence rose moderately, according to monthly surveys.

However, the Nuremberg Institute for Market Decisions (NIM) warned on September 26 that it was too early to conclude German consumer confidence had improved.

The improvement in Germany “can be interpreted more as a stabilization at a low level,” Rolf Bürkl, an expert at NIM, said.

“The slight increase cannot be interpreted as the beginning of a noticeable recovery.”