Mideast War Will Hurt European Growth

Iranian strikes on Israel would push global energy, shipping and food prices higher

A direct military conflict between Iran and Israel may erode the marginal economic growth that the 27-member European Union (EU) has recorded this year if global trade is disrupted by a steep rise in energy and shipping prices.

With the Persian Gulf accounting for 32% of the world’s oil production, energy prices would spike on an Iran-Israeli conflagration, adding pressure on EU governments already struggling to slow inflation and keep public deficits below 60% as mandated by the EU.

“The impact on energy prices would depend on damage to facilities, ships, and confidence,” Paul Sullivan, a Washington-based energy and Middle East expert and advisor to energy companies, said in response to e-mailed questions. “It would also depend on how long oil trade and markets are disturbed. The worst case? Get ready for $150 to $250 per barrel and a world recession with high inflation.”

The World Bank said in April that if there was a severe disruption in oil supplies from the Middle East, oil prices could surpass $100 per barrel, raising global inflation in 2024 by nearly one percentage point. An escalation would also drive up prices of natural gas, fertilizers, and food, the World Bank said.

“Upside risks to inflation also stem from the heightened geopolitical tensions, which could push energy prices and freight costs higher in the near term and disrupt global trade,” Christine Lagarde, the European Central Bank (ECB) president, said on July 18 following the Bank’s decision to cut interest rates.

EU Economic Growth

A steep acceleration in inflation would slow the EU’s economic recovery. Fitch Ratings raised on August 5 its 2024 eurozone real GDP growth forecast to 0.8% from 0.6% in its June Global Economic Outlook

“Economic recovery prospects have firmed up as the reversal of the 2022 terms-of-trade and energy shocks supports companies’ and consumers’ real incomes,” Fitch said. “Lower wholesale gas prices have largely reversed the terms-of-trade shock, boosting real incomes alongside disinflation.”

Natural gas futures prices in Europe hit their highest level of the year in the aftermath of Ukrainian forces taking control of the last remaining transit hub for Russian gas into Europe during a surprise incursion a week ago into the southwestern Kursk region.

European gas prices rose to €40 megawatt per hour on August 8 for the first time since December 4, according to Dutch banking group ING.

Energy Prices Subdued

Historically, conflicts in the Middle East have led to immediate spikes in oil prices and tanker rates. Critical oil transit chokepoints like the Strait of Hormuz, the Suez Canal, and the Bab el-Mandeb Strait make the region a focal point for global energy supplies.

Energy prices have remained relatively subdued despite the risk of war, a situation that may have more to do with concerns about the global economy and recession than Mideast tensions. Stocks on Wall Street tumbled sharply on August 5 amid growing fears of a slowing US economy that set off another sell-off for financial markets worldwide.

The impact on Europe will likely depend on the severity of Iran’s response to the assassination of Hamas’ top political leader, Ismail Haniyeh, in Tehran on July 31. Israel was behind the explosive device covertly smuggled into the Tehran guesthouse that killed Haniyeh.

“Iranian armed forces-run Defa Press published a list of potential civilian and military targets in Israel on August 5,” the Institute for the Study of War wrote. Iran included oil and gas fields, airports, shipping ports, and power plants in the target in Israel, likely to “generate both economic and informational effects on Israel,” it said.

Iranian Response

While there are diplomatic efforts underway to mitigate Iran’s response, Tehran will “feel the need to respond to Israel’s attack for both international and domestic political reasons,” Alexander Palmer, an associate fellow in the Warfare, Irregular Threats, and Terrorism Program at the Center for Strategic and International Studies, said.

“The killing of Hamas political leader Ismail Haniyeh in Tehran on July 31 has pushed Iran’s leaders into a dangerous corner,” Palmer wrote. “Tehran has few options but to escalate the conflict, as it did with its attack against Israel in April.”

Iranian drones and missiles targeted Israel in strikes on April 13 considered designed to minimize casualties while maximizing spectacle. Iran struck retaliation for Israeli airstrikes on Iran’s consulate in Damascus earlier in April that killed a top commander.

“The key risk here is geopolitics and potential disruptions to the physical production of oil in the Middle East or to the supply,” the head of EMEA Corporates, Natural Resources and Commodities team at Fitch Ratings Angelina Valavina, told Bloomberg Television.

Shipping Disrupted

Iran has already disrupted global trade through its proxy forces.

Greek Rear Admiral Vasileios Gryparis, Head of the European Union's Naval Force in the Red Sea highlighted on July 18 the significant threat posed by attacks from Iranian-backed Houthi fighters in Yemen. They have targeted ships linked to Israel, the US, and the UK near the Bab el-Mandeb Strait.

“We don’t have that many assets and the whole area we have to cover is enormous. I am pressing all the member states to provide more assets”, he cautioned in June.

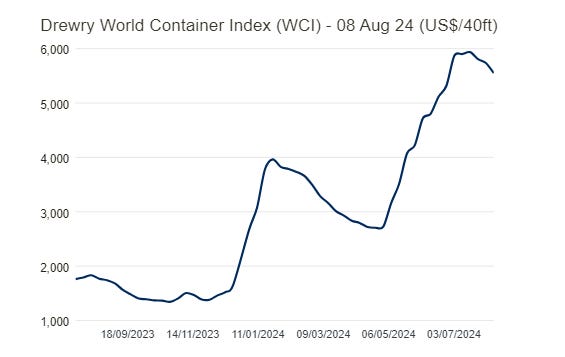

The attacks have forced shipping companies to divert their vessels from the Suez Canal, which handled about 30% of global container trade, to the longer Cape of Good Hope route. The Drewry’s World Container Index was $5,551 per 40ft container for the week ended August 8, compared with $1,761 per 40ft container a year ago, a steep rise due to the Red Sea attacks.

Concerns about the impact on Eurozone inflation were quite high at the start of the year due to the shipping disruptions. Oxford Economics wrote on February 1 that it would result in a peak lift of 0.3 percentage points to eurozone headline inflation and 0.4 percentage points to core inflation in 2024, with the brunt of the impact coming in H2.

A.P. Moller - Maersk

A.P. Moller - Maersk, one of the world's leading shipping companies, has been impacted as it reroutes vessels around the Cape of Good Hope, creating challenges for logistics and supply chains. CEO Vincent Clerc noted that the extended travel routes have required more ships, leading to capacity constraints and higher operational costs.

This, though, has not hit the company’s revenue.

A.P. Moller - Maersk continued to build momentum in the second quarter reporting volume growth across all segments and improved financial performance. Its earnings before interest and taxes (EBIT) margin reached 7.5% compared to 1.4% in the first quarter.

“Due to continued supply chain disruptions caused by the ongoing situation in the Red Sea/Gulf of Aden and robust container market demand, Maersk raises its financial guidance,” the company said on August 7. “Maersk now expects global container market growth to be between 4-6% and to grow in line with the market compared to the previous expectations of towards the upper end of 2.5-4.5%.”