UK, EU Leaders Hail ‘New Chapter’ in Economic Ties

Ryanair CEO says UK-EU deal can really transform British economy after Brexit 'economic disaster'

Top leaders from the United Kingdom and European Union (EU) have declared a “new chapter” in relations after the first formal UK-EU summit since Brexit.

Meeting in London on Monday, British Prime Minister Keir Starmer hosted European Council President António Costa and Commission President Ursula von der Leyen. The meeting sealed a wide-ranging “strategic partnership,” resetting ties.

“This summit marks a new chapter in the relationship between the United Kingdom and the European Union,” Costa said. Starmer hailed the breakthrough as a “win-win” for both sides and evidence that “Britain is back on the world stage, working with our partners, doing deals that will grow our economy.”

Von der Leyen likewise praised the “historic moment…opening a new chapter in our unique relationship.” She credited Starmer’s leadership for making it possible. All three leaders stressed moving beyond the “stale old debates” of Brexit toward pragmatic cooperation.

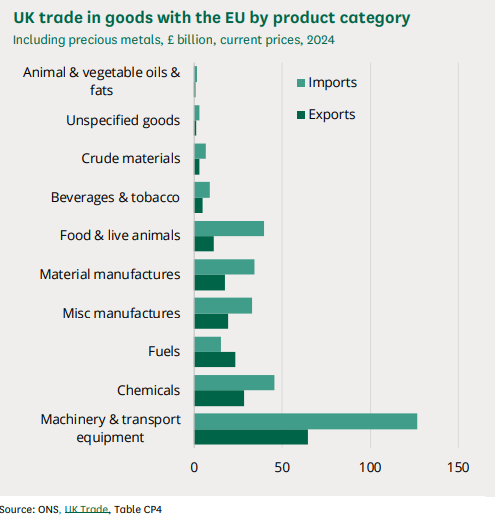

The UK voted to leave the EU in a referendum in June 2016. The Office for Budget Responsibility estimated that since the UK’s departure, the reduction in trade has led to a 4% drop in the potential productivity of the UK economy. It is also estimated that the volume of UK imports and exports will decline by 15% compared to if they had stayed in the EU.

Business leaders and pro-Europe lawmakers have lauded the reset as long overdue. The centrist Liberal Democrats called it a “positive first step” to rebuild ties.

Trade Breakthroughs and a Contentious Fishing Deal

The summit produced tangible agreements aimed at boosting economic ties. Officials announced plans to ease post-Brexit red tape on food and agricultural trade.

UK exporters have faced onerous paperwork and border checks. The UK government said some routine sanitary and phytosanitary checks on animal and plant products will be “removed completely. "

In return, Britain granted European fishing vessels an additional 12 years of access to UK waters, extending the current arrangements from 2026 to 2038.

The British National Federation of Fishermen’s Organisations said it was “very disappointed” with the deal. The extension “surrenders the best prospect that the fishing industry and coastal communities had for growth over the coming decade,” it said.

British Businesses Back Reduction in Trade Barriers

Other business groups welcomed the reduction of trade barriers, hoping it would lower costs and prices. Major supermarkets and food and drink companies hailed the agrifood deal as a game-changer.

“Anything that encourages closer trading ties between the UK and Europe is to be welcomed,” Ryanair CEO, Michael O’Leary, told Sky News. “It won't make much difference to the European economy, but it can really transform the UK economy. Brexit has been an economic disaster for the UK.”

Starmer vowed the deal would deliver “cheaper food and energy” for consumers. He touted measures to end tedious passport queues for UK travelers in Europe by expanding e-gate access at EU airports.

The two sides agreed to work toward mutual recognition of professional qualifications and easier short-term business travel, which would invigorate commerce.

New Security and Defense Partnership

The officials reached a Security and Defence Partnership, the first formal defense pact between the EU and its former member.

Britain and the EU pledge to coordinate on foreign policy, military missions, and emerging security threats, from cyber attacks to hybrid warfare. The agreement allows the UK defense industry to collaborate in European initiatives.

Von der Leyen highlighted that it is “the first step towards the UK’s participation in the European defense investment program, SAFE. The program provides €150 billion of loans for joint procurement.

British defense firms, such as BAE Systems Pls (OTCPK: BAESF) and Rolls-Royce Holdings Plc (OTCPK: RYCEY), could soon start collaborating with the EU on developing and purchasing military capabilities. BAE Systems shares are up 60% year-to-date.

“Without question, signature of the pact at the summit is desirable,” the Center for European Reform said ahead of the summit. “But in the near future it will not create the single European defence market, including the UK, that some member-states would like to see.”

The leaders emphasized that NATO would remain “the cornerstone” of European collective defense. The EU-UK pact will complement NATO by enabling quicker, more economical defense cooperation and force interoperability.

Investors, Markets Gain on UK-EU Reset

Financial markets reacted positively to the landmark deal, viewing it as a path toward certainty and an improved business climate. In London, the FTSE 100 stock index climbed to its highest level in seven weeks on the day of the summit, closing up 0.2% after an early-session rally.

Investors appeared to shrug off unrelated global jitters, such as a US credit rating downgrade, to focus on the UK-EU détente. The more domestically focused FTSE 250 also held onto recent gains.

Across the Channel, European equities broadly ticked higher the next day, buoyed in part by the UK-EU breakthrough. The pan-European STOXX 600 index rose about 0.7% on Tuesday, and Germany’s DAX index notched a record high. The Euro STOXX 50, representing blue-chip eurozone firms, likewise advanced as markets digested the easing of trade frictions.

The agreement reassures “companies that the terms of EU market access from the UK will at worst be stable and could improve further,” Andrew Wishart of Berenberg Bank said.

British Pound Strengthens on UK Economic Optimism

The British pound has been strengthening in currency markets, reflecting optimism about the UK’s economic outlook post-deal.

Research from ING noted that an “improved trade picture,” including deals with the EU, US, and India, has supported sterling. They have kept the euro under pressure.

With the Bank of England leaning hawkish on interest rates, some strategists see the pound as “the strongest story in G10” currencies. The summit’s success, they argue, is one more factor bolstering investor confidence in the UK’s direction.

For its part, the euro was steady as the pact removed a minor cloud over EU-UK economic relations. Government bonds and other assets saw activity from the summit, indicating that markets had partly anticipated a rapprochement.

Opposition, Conservatives Criticize UK-EU Reset

Domestically, the Conservative Party and the Eurosceptic Reform UK party, led by Nigel Farage, condemned the deal as a “surrender.” They argued it could make Britain a “rule taker” beholden to Brussels' regulations.

Critics seized on the fishing extension and prospects of aligning with EU standards as proof that UK sovereignty was being eroded.

“Starmer always throws the working people of this country under the bus,” Matt Goodwin, a British academic, writer, pollster, and campaigner, posted on X. “Starmer is putting Nigel Farage and Reform on steroids. Labour’s Brexit reset will bring about its own demise.”

Starmer rejected the criticism.

“It’s time to look forward… to common-sense solutions which get the best for the British people,” he said. He urged that the UK must end “political fights” over Brexit ideology.