Starmer Woos Global Investors at UK Investment Summit

Starmer said government would 'rip out the bureaucracy that blocks investment'

British Prime Minister Keir Starmer unveiled that he wants to attract billions of pounds of investments during his speech at the International Investment Summit on Monday.

The inaugural International Investment Summit in London secured £63 billion in investments and nearly 38,000 in jobs, Chancellor of the Exchequer Rachel Reeves posted on X.

But the one-day summit underscored the challenges that Starmer and his cabinet face in reviving the country’s struggling economy. UK GDP grew at 0.2% in August after flatlining in June and July.

Starmer told 300 executives attending that his government would "rip out the bureaucracy that blocks investment” by slashing red tape.

"Private sector investment is the way we rebuild our country and pay our way in the world,” he said. “Make no mistake, this is a great moment to back Britain.”

UK Summit Attracts US Data Center Providers

US firms CyrusOne, ServiceNow, Cloud HQ and CoreWeave announced as part of the summit that they would invest a total of £6.3 billion in the country’s data infrastructure. That takes the total investment in UK data centers to over £25 billion since the Labour government took office.

British Technology Secretary Peter Kyle welcomed the ‘vote of confidence' in Britain.

“Tech leaders from all over the world are seeing Britain as the best place to invest with a thriving and stable market for data centers and AI development.”

ServiceNow (NYSE:NOW) plans to invest £1.15 billion into its UK business over the next 5 years.

“AI-powered transformation is a generational opportunity,” ServiceNow Chairman and CEO Bill McDermott said. “ServiceNow's investment will accelerate the UK's innovation blueprint.”

UK Secures Billions of Investments

Labour said it secured “tens of billions worth of investments within 100 days of being in office.” That included more than £24 billion worth of investment in clean energy projects.

Spain’s Iberdrola (OTC: IBDRY), one of the biggest energy companies in Europe, doubled its investment in the UK to £24 billion. Denmark’s Orsted (OTC: DOGEF) unlocked £8bn and GreenVolt £2.5bn of investment in offshore wind farms.

Confidence in the economy, though, has been hurt by social tensions around illegal immigration and uncertainty about the upcoming budget. An escalation in geopolitical tensions in the Middle East has also undermined sentiment.

Starmer’s and Reeve’s popularity has fallen steeply since they won elections in July. In September, consumer confidence crashed by the most in two-and-a-half years.

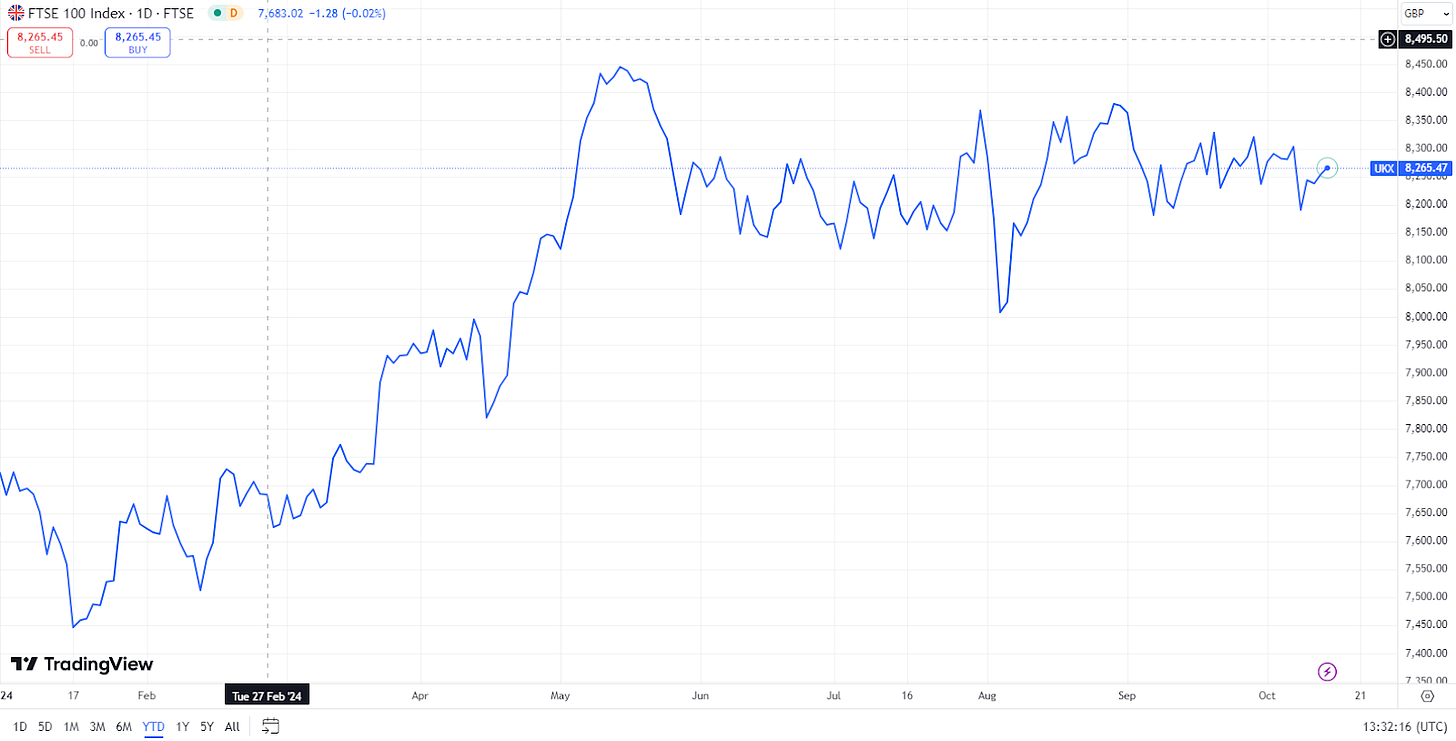

The FTSE 100 traded flat after Starmer’s speech. With UK jobs data due out Tuesday and inflation on Wednesday, markets focused on key economic data.

UK Investment Summit Gets Support from Banks

Ahead of the UK Investment Summit, some of the world’s biggest banks and companies offered an upbeat message. In a letter to The Times, five of the world’s biggest banks joined private equity firms, insurers and tech giants to say it was “time to invest in Britain.”

The 14 signatories include JPMorgan, Goldman Sachs, Bank of America, Citigroup and UBS. Insurers Aviva and L&G signed the letter, alongside private equity firms including Blackstone and KKR.

They pointed to stability, universities, legal expertise and financial services already providing the “bedrock of a strong investment proposition.” Growth in the technology and energy sectors had “further enhanced Britain’s position.”

Confirmed speakers included Ruth Porat, President & Chief Investment Officer of Alphabet and David A. Ricks Chair and CEO of Eli Lilly. Alex Kendall, CEO of Wayve, and Pushmeet Kohli Vice President of Research at Google DeepMind, were confirmed to attend.

Some participants, though, expressed frustration about the lack of information surrounding the summit, CNBC reported. Many multinational executives and tech leaders declined to attend or weren’t invited. The Financial Times partly attributed the summit's turnout to concerns over its "quality and organization.”

UK Investment Summit Undermined by Musk Controversy

Critics have also questioned the Labour Party’s decision not to invite billionaire Elon Musk to the UK Investment Summit.

“Extraordinary failure by the UK government to exclude @elonmusk from the UK Business Summit,” James McMurdock, a Reform UK MP, wrote on X. “His absence is a blow to Britain’s future and growth potential. We should be engaging with global innovators, not sidelining them.”

Technology Secretary Peter Kyle denied Musk had been snubbed. But British Business Secretary Jonathan Reynolds failed to provide a clear answer as to why Musk wasn’t invited.

“I am not going to comment on the reasons for any specific person,” he said during an interview on Sky News. “If people have an investment proposition for the UK, I will talk to them about it.”

Musk Hits Back after Not Being Invited

Musk hit back after not being invited. "I don’t think anyone should go to the UK when they’re releasing convicted pedophiles in order to imprison people for social media posts," Musk posted on X.

He was apparently referring to the government’s decision to release hundreds of inmates — though not sex offenders — early because of overcrowded prisons, the Independent reported.

Musk has clashed with British officials about their crackdown on free speech.

The tech billionaire posted a comment on X saying that “Civil war is inevitable” in the UK.

Justice Minister Heidi Alexander said that using language such as “civil war” was unacceptable.