Lagarde Warns of ‘Profound’ Uncertainty Ahead

Gold hits record high, dollar weakens on Fed rate cut

The European Central Bank (ECB) President Christine Lagarde warned that the “uncertainty ahead is still profound” shortly after the Federal Reserve, the ECB, and the Bank of England (BOE) made decisions about their countries’ interest rate policies this month.

Today’s global economic pressures resemble those that "took place a century ago," resulting in “economic nationalism," a collapse in global trade and the Great Depression of the 1920s,” Legarde said in a speech on September 20 organized by the International Monetary Fund (IMF) in Washington.

“We have faced the worst pandemic since the 1920s, the worst conflict in Europe since the 1940s, and the worst energy shock since the 1970s," Lagarde said. These shocks “have changed the structure of the economy and posed a challenge for how we assess the impact of monetary policy,” she said, adding that it “typically takes 18 to 24 months for a change in interest rates to have its peak effect on the economy and inflation.”

Global economic headwinds persist that may drag on the Eurozone’s economy.

The military conflict in Ukraine shows no signs of ending and fighting in the Middle East threatens regional stability and global oil shipments. In the US, the upcoming US presidential elections and US deficit payments at annual interest costs of more than $1 trillion have prompted concerns about economic health in the world’s largest economy.

FED Rate Cut

Lagarde made her comments in Washington at the 2024 Michel Camdessus Central Banking Lecture two days after the Federal Reserve announced a 50-basis point cut in the US overnight borrowing rate target and laid out a path to lowering rates further.

This was the first interest rate cut by the Fed in four years, indicating that the US has shifted from fighting inflation to ensuring a soft landing for the US economy as unemployment rates slightly rise. Chairman Jerome Powell emphasized that inflation is “much closer” to its 2% target and the labor market is “less tight” than pre-pandemic in 2019.

“Our strategists believe this is the beginning of the Fed moving into a new stance – in the Fed’s eyes, recent slowing in the labor market is now a bigger risk than inflation.” JP Morgan wrote on September 19. “This cut in policy rates, and plans to lower rates further, is designed to support economic growth.”

Real GDP increased at an annual rate of 3.0% in the second quarter of 2024, according to the "second" estimate from the US Bureau of Economic Analysis, due to consumer spending, private inventory investment, and business investment. US annual inflation slowed to 2.5% in August, compared to the previous increase of 2.9%, according to US Labor Department data published on September 11.

Six days before the Fed cut, the ECB lowered its overnight deposit rate by 25 basis points. The ECB Governing Council said on September 12 that its expectations are for Euro area inflation to continue to abate, reaching the medium-term 2% goal in 2026.

Gold Surges

After the Fed decision, gold climbed to an all-time high, above $2,650. Goldman Sachs Research forecasts the price will reach $2,700 by early next year, buoyed by interest rate cuts by the Federal Reserve and gold purchases by emerging market central banks.

“Rate cuts by the Fed will likely bring Western investors back into the gold market after largely being absent during the metal’s sharp rally over the past two years,” Goldman said.

The EUR/USD broke above 1.1150 as the dollar weakened following the Fed's first rate cut in over four years.

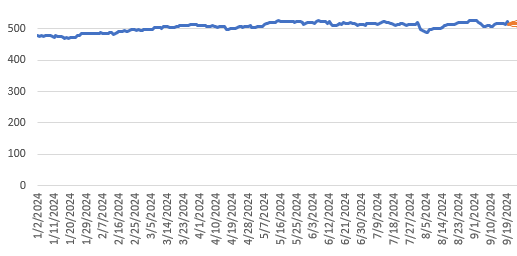

EUR/USD and Gold following ECB and FED decisions, Source: Trading View

While the ECB and the Fed lowered their rates by 50 basis points each in the past four months, with the ECB making its first 25 basis point cut in June, the BOE and the Bank of Japan (BOJ) left their rates unchanged.

The EUR/GBP exchange rate slid near a two-year low of 0.8390 in the wake of the decision and the GBP/USD exchange rate scaled a new two-and-a-half-year high at 1.3314.

Stocks Benefit

European markets responded to the ECB cut with a modest gain for the week ending September 13, with the German 40 GDAXI index leading Europe’s STOXX 50 and the French CAC 40 with a positive gain of 1%.

The week following the Fed cut its interest rates saw even larger gains, Germany’s 40 index reached an all-time high after closing up 1.6% higher at 19002.38 points on September 18.

STOXX 600 (STOXX)

European equity markets appear to have less risk concentration than the US, where the top seven companies accounted for 45% of market return in 2023 and leading technology companies continue to drive the market.

Morgan Stanley predicted European equities had the potential for 18% upside in 2024 at mid-year on May 28. Morningstar noted in their June 18 European Equity Market Outlook: Q3 2024 research note that European equities had risen 10% at the time and predicted increased positive moves.

Continued central bank easing in Brussels and Washington in the fourth quarter may provide the impetus for even higher gains in European and US stocks.

STMicroelectronics

STMicro (NYSE:STM) may benefit from the interest rate environment in the US and EU as lower rates can reduce the cost of capital and encourage more investment in AI infrastructure. With reduced CAPEX due to cheaper financing and more efficient capital allocation, STM could see an improvement in its free cash flow (FCF), reported at $159 million in Q2.

Despite declining revenues and net income year-on-year (YOY) in Q2, the Geneva-based company remained profitable, achieving a gross margin of 40% and a net financial position of $3.20 billion. As the company is actively engaged in the AI boom with its smart sensors for industrial and robotics applications, it may present a solid opportunity for investors seeking long-term growth potential without minding short-term volatility.

The company is extremely undervalued, considering its low trailing P/E ratio of just 7.35x, particularly in a high-growth industry with strong long-term growth prospects. The industry trades at a multiple of 29x, placing STM at a 10-year low.

As it manages double-digit profitability metrics during revenue declines, it remains 35% below its 52-week high and 48% away from the Wall Street price target.