Italian Economy Stagnates As Manufacturing, Fashion Slow

Italian luxury fashion house Gucci records steep drop in Q3 sales

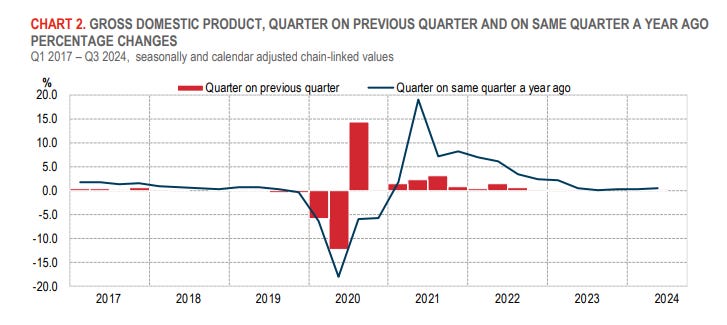

The Italian economy stagnated in the third quarter of this year as weak manufacturing and slowing exports weighed on growth.

The country reported no economic growth compared with 0.2% in the second quarter, according to data from the Nation Institute of Statistics (ISTAT). Although its GDP expanded 0.4% year-on-year in the third quarter, it missed economist expectations of a 0.2% rise quarter-on-quarter and a 0.7% increase year-on-year.

The economic performance has raised doubts that Prime Minister Giorgia Meloni's government will reach its target of 1% this year. Economy Minister Giancarlo Giorgetti said in October that the goal may be out of reach following downward revisions to the first two quarters, Reuters reported.

ISTAT said on October 4 that so-called "acquired growth" at the end of the second quarter stood at 0.4%, revised from 0.6%. It also lowered Italy’s year-on-year GDP growth rates for the first and second quarters.

“The international economy shows stable growth, but high uncertainty and downside risks remain,” ISTAT said on November 8. “In the third quarter, Italy’s GDP level, according to the preliminary estimate, remained unchanged compared to the previous three months, showing a worse result than its main European partners and the euro area average.”

Italian Consumer Confidence Weakens

Household confidence has deteriorated, “with a decline in opinions about the general economic situation and future prospects,” ISTAT said. “Business sentiment also declined, particularly in manufacturing and market services.”

The consumer confidence index dropped to 97.4 points in October from 98.3 points the previous month, ISTAT said on October 25. The business confidence climate, the ISTAT Economic Sentiment Indicator index, declined to 93.4 from 95.6 to 93.4 for the same period.

“Consumers are signaling a deterioration in economic conditions and are showing concerns about future economic developments,” ING Think said on October 25. “This is reflected in a sharp increase in expectations of future unemployment to the highest level since February 2023.”

ING forecasts that economic growth this year will remain unchanged from last at 0.7%. The Parliamentary Budget Office said that weak manufacturing activity and an uncertain outlook for construction were among the reasons the Italian economy may not reach its 2024 growth forecast.

Manufacturing Sector Downturn Hits Italian Economy

The Italian manufacturing activity contracted in October, marking a consecutive seven months of contraction in factory activity. The HCOB Italy Manufacturing PMI for euro zone's third-largest economy fell to 46.9 from 48.3 in September, declining further below the 50-mark separating growth from contraction.

“The plunge in foreign orders is particularly striking,” Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said about the PMI data. “Anecdotal evidence points to weak demand from the US and neighboring European markets as primary drivers.”

Feldhusen also attributed the decline to weakness in the automotive sector.

There are “mounting pressures” on the Italian automaker conglomerate Stellantis NV (NYSE: STLA), he said. The company is expected to reduce its production in Italy “by approximately one-third this year, according to reports,” he said.

“The parallels to Germany's Volkswagen are clear: both companies are suffering from higher international competition, especially from China, and sluggish demand for electric vehicles domestically.”

Volkswagen (OTC: VWAGY) announced last month the closure of three German factories and potential mass layoffs. High operating costs, a weak electric vehicle lineup, and diminishing demand in key markets drove the decision.

Fashion Sector Weakness Hits Italian Economy

The fashion sector, particularly luxury, has also suffered from a shift in consumer preferences. That was influenced by geopolitical uncertainty, weak demand in China and an increasing emphasis on sustainable consumption.

Sales in the fashion sector are expected to decrease by 3.5% in 2024, according to ISTAT projections. This would be a contraction from 2023 when the sector saw a 2.5% growth compared to 2022. There was also a 6.1% contraction in sales in the first half of 2024.

Italian luxury fashion house Gucci recorded a significant drop in sales in the third quarter, with revenue amounting to €1.6 billion, down 26% compared to the same period in 2023, reported Gucci parent company Kering (OTC: PPRUY). Salvatore Ferragamo (OTC: SFRGY) reported group revenues of €221 million in the third quarter, down 9.6% at current exchange rates compared to Q3 2023.

“The results of the third quarter have been impacted by the challenging macroeconomic and consumer environment and we expect this trend to continue in the last part of the year,” Salvatore Ferragamo CEO Marco Gobbett said.