Europe’s Crypto Regulation Heralds New Digital Currencies Era

Coinbase plans to delist unauthorized stablecoins that do not comply with MiCA

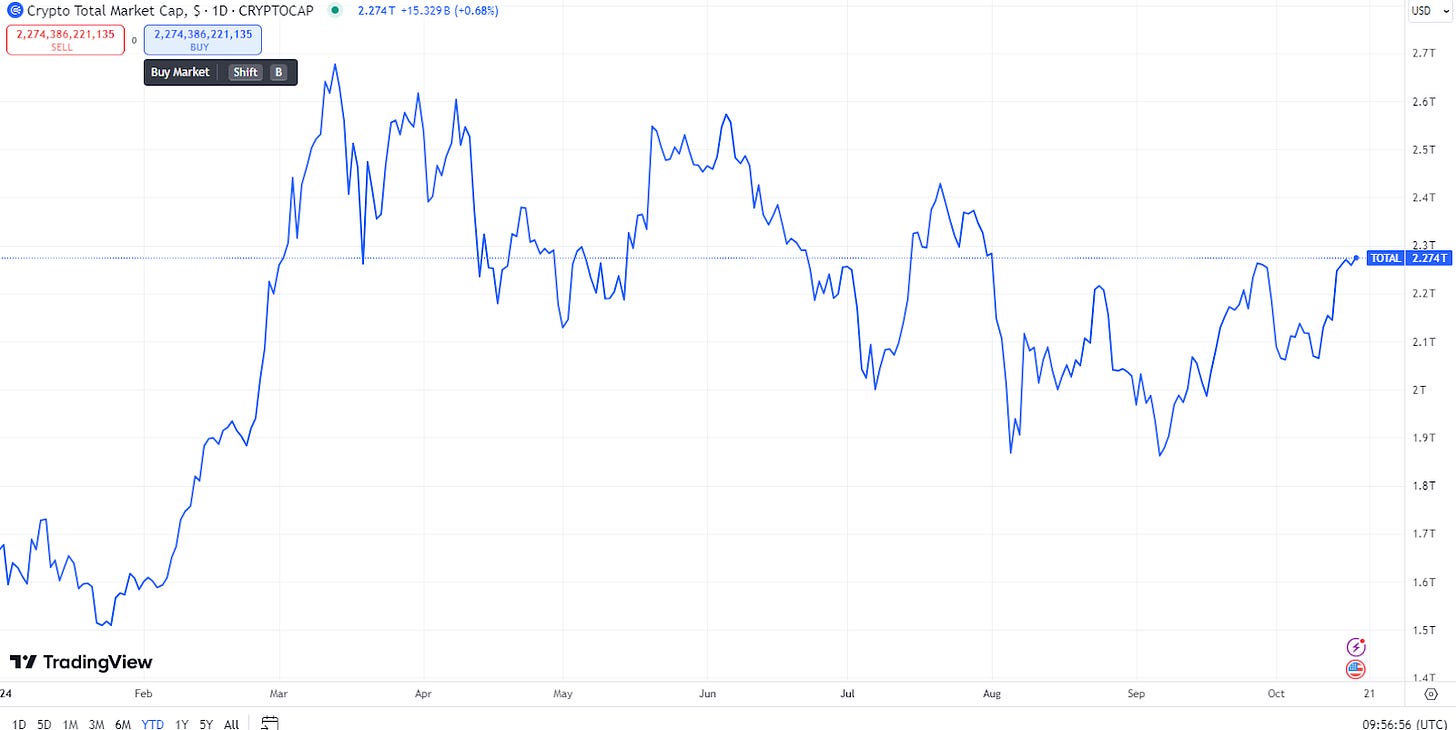

Europe’s crypto regulation, Markets in Crypto Assets (MiCA), heralds a new era for an industry that will provide access to about 18% of global crypto transaction volumes.

In an effort to create a framework for crypto regulation across all European Union (EU) member states, MiCA mandated that from June 30 onwards, all stablecoin issuers hold an Electronic Money Institution (EMI) license and exchanges with stringent compliance requirements.

Some exchanges have adjusted their offerings to include only stablecoins that meet the regulation’s requirements. They want to maintain access to a potential market of 200 million plus when MiCA is fully applied by year’s end.

MiCA is part of the EU's digital finance package designed to transform digital finance by mitigating associated risks. It applies to crypto assets not covered by existing financial legislation, specifically targeting stablecoins and crypto asset service providers (CASPs). It aims to create a legal framework of how stablecoins, such as Tether (USDT), and a wide range of other digital assets operate within EU borders.

MiCA “is a huge milestone,” CEO of Circle, the issuer of USDC and EURC, Jeremy Allaire said. It brings” digital currency into mainstream scale and acceptance,” he said.

Crypto Exchanges and Stablecoin-Issuers on MiCA

In response to MiCA, California-based exchange Coinbase (NASDAQ: COIN) plans to delist unauthorized stablecoins that do not comply with the new regulations.

"We intend to restrict the provision of services with stablecoins that do not meet the MiCA requirements," Brian Armstrong, Coinbase CEO, told CoinDesk on October 11.

Binance, the largest global cryptocurrency exchange, announced in early June that it won't delist any unauthorized stablecoins on the spot. But it will limit their availability for European users “only on certain products,” it said.

PayPal (NASDAQ: PYPL) issued its own regulated stablecoin, PayPal USD (PYUSD), through Paxos on August 7, 2023. PayPal operates under an EU banking license in Luxembourg, which grants it business access to the region under EU law.

Crypto issuer Circle has secured an EMI license. It did so under France's banking regulator, the Autorité de Contrôle Prudentiel et de Résolution. UK-based neobank Revolut also announced plans to launch its own stablecoin under MiCA.

Overview of EU’s Crypto Regulation

MiCA requires digital asset operators to obtain a license in an EEA member state to operate across the EU. Issuers of stablecoins with a fixed reference to a fiat currency, called E-money Tokens (EMTs), must hold at least 30% of their funds as bank deposits.

For stablecoins deemed “significant,” at least 60% of fiat reserves must be distributed across multiple institutions. This is based on criteria like market cap, user base, and transaction volume and systemic importance.

The regulation requires stablecoin issuers to disclose detailed information about their reserve assets and adhere to liquidity. They must maintain capital standards and ensure consumer protection.

For example, stablecoins must be backed by a liquid reserve with a 1/1 ratio and partly by deposits. Moreover, issuers must offer redemption rights to holders, thus enhancing the stability and reliability of these digital assets.

MiCA Mandates Details of Potential Risks

Additionally, MiCA mandates the publication of white papers detailing potential risks and impacts for crypto assets. It also demands detailed disclosures of reserve assets and imposes liquidity and capital requirements stablecoin issuers must now navigate.

MiCA imposes usage caps on foreign currency EMTs, such as USDC and USDT, limiting them to 1 million daily transactions or €200 million in daily transaction value within the EU.

These measures are expected to enhance trust in digital assets, potentially leading to broader adoption and integration into traditional financial systems. The regulatory clarity and single market license could benefit European exchanges and crypto businesses by enabling them to operate across the entire EU.

But the regulation introduces complexities that could stifle smaller market players due to increased operational costs and compliance burdens.

New Era for the Crypto Industry

Tether, which has long been criticized for lacking transparency and reserve management, has condemned the MiCA's requirements.

They “could not only render the job of a stablecoin issuer extremely complex but also make EU-licensed stablecoins extremely vulnerable and riskier to operate,” CEO Paolo Ardoino told crypto research portal The Block in early June.

Tether has not yet secured the EMI license. However, it “is developing a technology-based solution” “to serve the necessities of the European market.”

“As with any regulatory framework of this scale, further discussions on the technical implementation standards are crucial to providing clarity," Ardoino said.

Crypto Industry Fragmented in the US

The regulatory approach to cryptocurrencies remains fragmented across the Atlantic, with different states and federal agencies imposing varying rules. The US has yet to implement a comprehensive framework.

Discussions around stablecoin regulation and central bank digital currencies (CBDCs) are ongoing. This disparate regulatory environment creates uncertainties for crypto businesses operating across jurisdictions, including Coinbase, Kraken and Bitstamp.

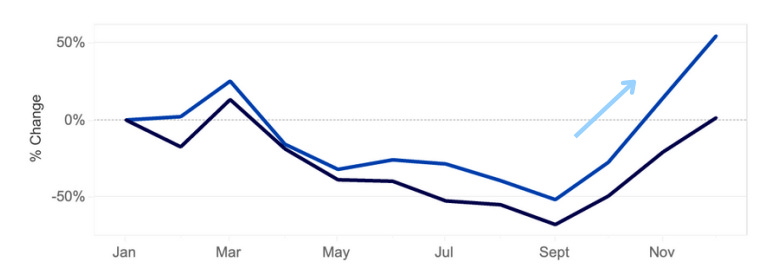

The regulatory approach in the US in 2023 has resulted in an increase in euro-dominated trading volumes at a faster pace than the dollar.

Notably, the euro leads the dollar in cryptocurrency trading as only 1% of transactions were completed using stablecoins versus 90% in the US.

The institutionalization of the European crypto market is well on its way following the launch of cash-settled micro euro-dominated Bitcoin and Ethereum futures contracts in March 2023.

MiCA’s emphasis on transparency, stability and market integrity could serve as the blueprint for European crypto institutionalization.

Access to the European Market

The opportunity for big crypto players is immense. The market size of European cryptocurrency exchanges is projected to grow to $14.3 billion this year. It reach 218.6 million users by next year,

Coinbase has been focusing on expanding its presence in Europe. Its international business, which includes Europe, contributed approximately 17% of its total revenue in Q1 2024. By aligning with MiCA, Coinbase can leverage its regulatory approach within Europe and potentially increase its regional revenue share through derivatives in Europe.

Furthermore, Coinbase's strong foundation with USDC, Circle’s MiCA-compliant stablecoin, positions the company to benefit from the regulatory environment in Europe. In Q2, Coinbase saw transaction volume on USDC on Base, its stablecoin, reach $20 billion in a few weeks.

The world’s biggest tech companies have been waiting for regulatory clarity to integrate crypto. With MiCA, “they're all hoping that it happens in the US as well,” Armstrong said. “We’re bullish on this.”