Europe Risks Losing Race for World’s Most Critical Tech

ASML, AI startup Adaptive ML voice concerns about migration restrictions on EU tech

The European Union (EU) risks losing the microchip tech war to China and the US as tech companies navigate political efforts to impose stricter migration policies, lower investment volumes and heavy-handed regulations.

Within the 27-member bloc, migration has become a divisive issue, separating much of the public who want to see a slowdown in migration and businesses that worry they may lose out on the expatriate talent they need to compete. Both China and the US are pouring billions of dollars into winning the race for microchip technology.

European tech companies, such as Netherlands-based ASML Holding N.V. (ASML:NA) and French AI startup Adaptive ML, have voiced concern over the potential negative impact of strict migration policies following considerable gains by right-wing parties in recent European elections.

In early July, the Netherlands swore in its first far-right government after the Party for Freedom (PVV) swept national elections in November. PVV leader Geert Wilders, who founded the party in 2006, has called for halting the acceptance of asylum seekers, among other measures, and has criticized Islam as being incompatible with Dutch society.

ASML, a semiconductor company with a market capitalization of $360 billion, warned the Dutch government that it would take its business elsewhere if too many curbs are placed on the influx of international students and expat workers. It did so after the Dutch lower house of parliament approved legislation, effective from January 1, 2024, to restrict the 30% preferential tax treatment provided to eligible highly skilled foreign workers.

“If we cannot get the people here, we get the people somewhere else,” ASML CEO Peter Wennink said in a January call with investors. “We will go where we have access to the means to grow the company." Around 40% of ASML's 23,000 employees in the Netherlands are not Dutch.

The New Oil

The Dutch government scrambled to ensure ASML did not move operations or expand abroad after the tech firm voiced its concerns. The Dutch newspaper De Telegraaf reported in March that the government launched a cross-ministry effort, dubbed “Operation Beethoven,” to encourage ASML to stay in the country.

With the global market for semiconductors projected to reach $1 trillion by 2030, up from $600 billion in 2021, ASML is an important part of Europe’s efforts to carve out a 20% market share in a sector responsible for running virtually everything. Semiconductors are used for missiles, smartphones, microwaves and stock markets.

There is intense global competition to dominate the development of semiconductors, a technology that may be as important to the 21st-century economy as oil was to the 20th’s industrial development.

The EU Chips Act from September 2023 aims to ensure that the EU strengthens its semiconductors ecosystem, increases its resilience, as well as guarantees supply, and reduces external dependencies. The EU has only roughly 10% of the global market share and is heavily dependent on third-country suppliers – nearly 80% are headquartered outside the EU.

However, the EU’s lack of funding in the has already put the bloc at a disadvantage.

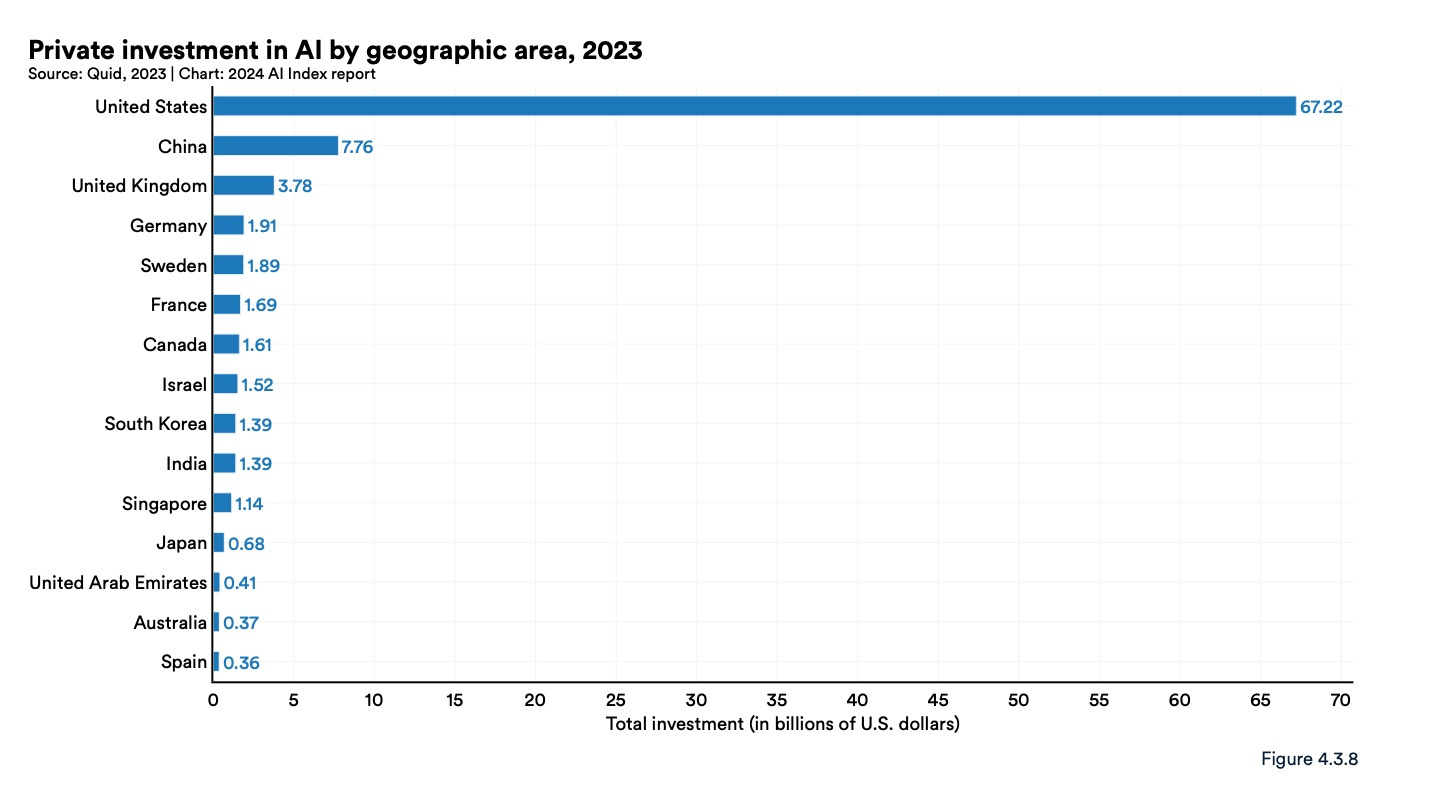

Private investments in AI in the U.S. totaled $67.2 billion in 2023, followed by $7.76 billion in China, $3.78 billion in the U.K., leaving Germany, Sweden, and France trailing behind with investment totals amounting to less than $2 billion, according to the 2024 Stanford AI Index.

French Efforts

French President Emmanuel Macron has prioritized supporting homegrown tech companies, helping startups hire from abroad, and attracting investment from larger tech companies. In May, Macron unveiled more than €15 billion in foreign investments from companies like Amazon (AMZN.O), Microsoft (MSFT.O) and Morgan Stanley (MS:US).

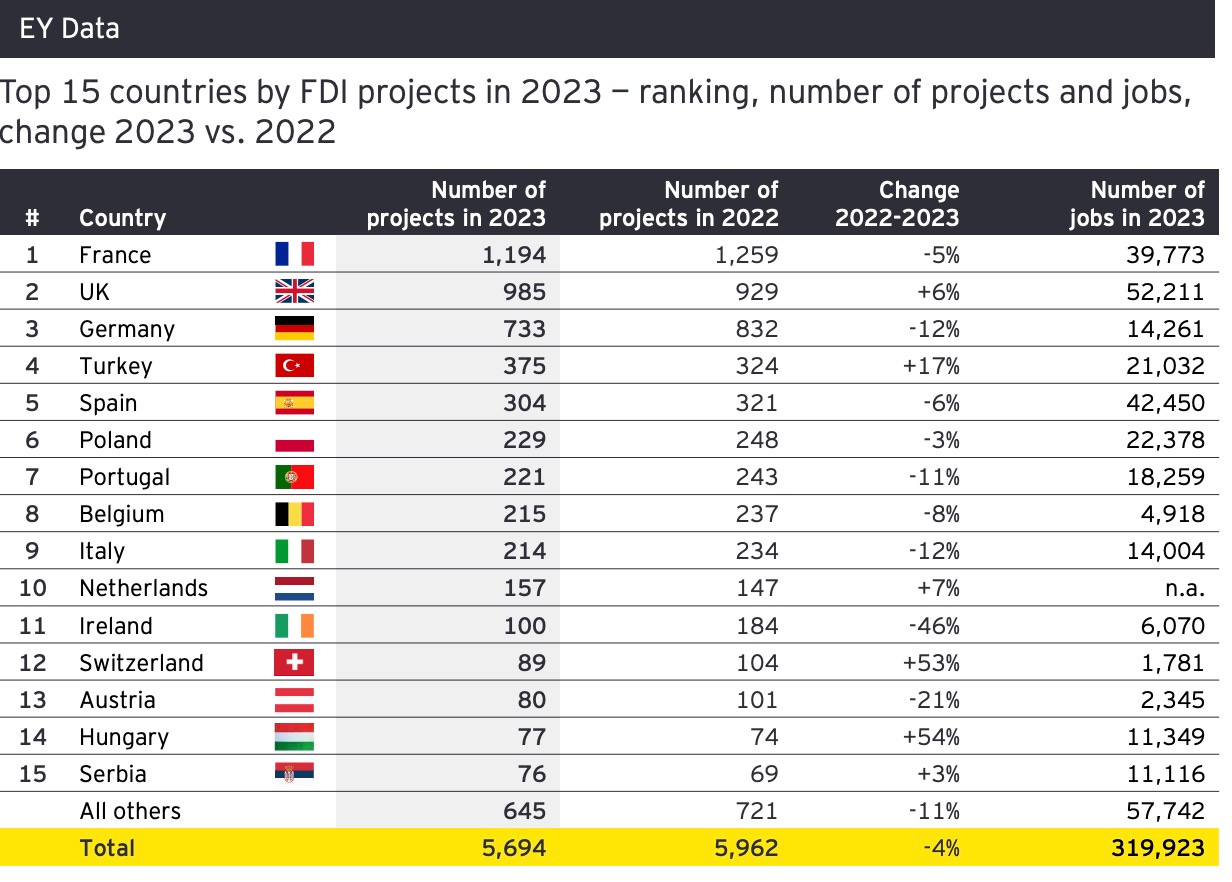

Macron wants to attract investment as a part of his plan to better integrate capital markets across the continent and to make Paris a more attractive financial hub. France remains the main destination for global investors in Europe, according to consultancy firm EY’s ranking.

France has also sought to assert its position as an AI leader. Its National Strategy for AI (SNIA), launched in 2018, affirmed AI as a strategic priority for France. In May, Macron dedicated nearly €2.5 billion from France 2030, a €54 billion national investment plan, to AI development.

Paris ranked second place to London in the second quarter of 2024 in terms of venture capital investment, reaching $4.3 billion. Tech startups in France have also been popping up in France at a faster rate than anywhere in Europe, with close to 3,000 founded in 2023, according to a report by Atomico.

Tech Companies Warn

French tech companies, though, have warned that the far-right National Rally’s immigration plans may threaten these efforts. The National Rally party wants to "stop migratory submersion" by "drastically reducing legal and illegal immigration" and "deporting foreign delinquents."

Camille Lemardeley, general director of Superprof, an online tutoring platform, said that the National Rally’s planned policies could create a less welcoming environment for international professionals, affecting the broader business climate.

"This could have a ripple effect on innovation and competitiveness, not just for Superprof, but for the entire French tech ecosystem," Lemardeley said.

Julien Launay, CEO of AI startup Adaptive ML, said foreign immigration is a crucial drive for start-ups. "In the two previous startups I've worked at, skilled immigration to France was a big driver of talent," he said in June.

Over Regulation

Tough immigration policies and a lack of funding are the only two things curbing EU competitiveness in tech. The bloc risks falling behind due its to over-regulation

Regulatory requirements imposed by the EU’s Digital Markets Act (DMA), including hefty fines reaching up to 10% of a company’s total worldwide annual turnover or 20% in the event of repeated infringements, have caused EU tech companies to consider leaving the continent.

In 2023, Munich-based start-up Marvel Fusion, a global leader in fusion technology, announced it would move most of its research and development to the US due to excessive regulation and lack of funding in Europe.

“There is still no instrument at the European level that could promote fusion projects,” Marvel chief operating officer Heike Freund said. “That has to change, and something has to develop here so that we can tackle our next project here in Europe and Germany. The USA is much further ahead in this regard.”