Euro Area GDP Beats Expectations, Driven by Exports Before US Tariffs

Euro moves back above $1.13 against the dollar on Friday on Euro Area inflation data

The Euro Area economy grew stronger-than-expected in the first quarter, driven by higher exports in anticipation of US tariffs.

Gross domestic product (GDP) expanded by 0.4% in the Euro Area and by 0.3% in the European Union (EU) in Q1, compared with the previous quarter, Eurostat, the EU’s statistical office said on Thursday. GDP increased by 1.2% in the Euro Area and by 1.4% in the EU in Q1 from the year-ago quarter, the data showed.

The Euro Area has reported five consecutive quarters of economic growth, after flatlining the last two quarters of 2023, according to data from Trading Economics. Quarterly GDP outpaced expectations of 0.2% and signals a modest pickup in economic momentum across the 20-member currency bloc.

“First quarter growth was likely driven by higher net exports in anticipation of US tariffs,” ING Think said in response to the Eurostat data. “Although France, where GDP components have already been published, did not seem to benefit from this trend.”

German Benchmark Index DAX 40 opened 1.50% higher after a May 1 holiday, trading above 22,800. The latest rally pushed it just 2.50% below the all-time high achieved this March.

Ireland Leads Euro Area Growth, with Spain, Lithuania Following

According to Eurostat data, Ireland recorded the highest quarterly increase in GDP at 3.2% among the member states in the Euro Area. GDP in Spain and Lithuania followed, expanding 0.6% in the first quarter.

Spain's statistics agency said on Tuesday that the first three months of the year saw its weakest economic growth in seven quarters. France, the second-biggest economy in Europe, expanded a meager 0.1%, Eurostat data showed.

For the entire year, ING Think expects average GDP growth in the Euro Area “will benefit from a strong first quarter, but even then, overall growth for 2025 is likely to reach 0.7% at best.”

“In today’s world, first quarter GDP figures are already ancient history and do not provide much insight into future performance,” ING Think said. “ April's initial data already shows a notable decline in confidence.”

Trump’s Economic Policies Spur Euro Area Uncertainty

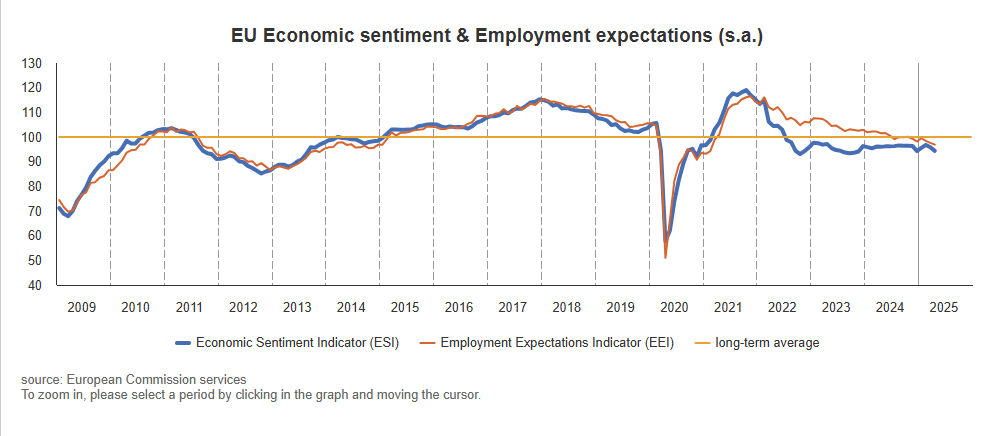

A rise in global trade tensions and growing uncertainty surrounding US economic policies has sparked concerns about the Euro Area economy. Economic sentiment in April plummeted to multi-year lows after US President Donald Trump’s “Liberation Day” speech.

President Trump sent ripples through the global economy when he announced his reciprocal tariff strategy from the White House on April 2. On April 5, a 10% flat-rate tariff came into force on all goods imported into the US.

“The defining contribution of Trump’s first 100 days has been the injection of uncertainty: into international relations, into trade,” Bronwen Maddox, Director and Chief Executive at Chatham House, wrote on April 29.

The Economic Sentiment Indicator in the Euro Area declined by 1.4 points in April to 93.6, according to data from the European Commission (EC). Economic confidence in the EU dropped by the same amount to 94.4.

This reflected “a broad-based decline in confidence across all sectors,” Trading Economics said. Consumer confidence also decreased for the second month in a row in both the EU and the euro area, according to EC data.

Euro Rises Against Dollar on Euro Area Inflation Data

After declining over 2.7% from its 1.15500 peak in April, the euro moved back above $1.13 against the dollar on Friday. This move was after stronger-than-expected Euro Area inflation data and ahead of the U.S. non-farm payrolls report, as investors look for clues on the Federal Reserve’s policy outlook.

The latest CPI figures showed Euro Area inflation held steady at 2.2% in April, according to Eurostat data. Services inflation accelerated to 3.9%, and core inflation, which excludes food and energy, rose to 2.7%, surpassing forecasts.

Economists had expected a slowdown to 2.1% in a Bloomberg survey. National reports this week showed slight decelerations in Germany and France, while Italian and Spanish inflation held steady. Bloomberg reported.

European Central Bank (ECB) officials displayed growing optimism in reaching their 2% goal this year. President Christine Lagarde said last week the task is “nearing completion.”

“April’s rise in services inflation is unlikely to worry the ECB too much as it was probably driven mainly by Easter timing effects.” Franziska Palmas, senior Europe economist at Capital Economics, said. “We think services inflation will start falling again in the coming months and that US tariffs will prove disinflationary for the euro-zone, paving the way for two more rate cuts this year.”