EU Recyclers Could Benefit from Bloc’s CRM Push

EU sources almost all of its CRMs from external suppliers

European recycling companies and deep sea miners will likely benefit from the region’s push to reduce its dependency on imported critical raw materials (CRM).

By 2030, the European Union (EU) aims to meet 25% of its critical mineral needs through recycling rather than imports, making it a viable long-term solution to the bloc's raw material supply challenges. The EU sources almost all of its CRMs from external suppliers, including 100% of its heavy rare earth elements from China.

The EU’s objective to cut greenhouse gas emissions by at least 55% by 2030 as part of its path to becoming climate neutral by 2050 has highlighted the need to diversify its supplies of CRMS. CRMs are found in products essential to the economy of every member state.

The effort to diversify the CRM supply chain is creating opportunities for European companies such as Carester. The French start-up is actively collecting old magnets to extract rare earth oxides. The company plans to begin processing in 2026, targeting an initial capacity of 2,000 tons annually to help meet demand for CRMs.

"Today you have magnets that are leaving Europe every day because there is no possibility to recycle them here," Frédéric Cerancotte, the founder of Carester, told Reuters.

Positive Impact

The re-election of Ursula Von Der Leyen as the President of the European Commission should have a positive effect on the EU’s mining sector, owing to her strong support to transition to green technologies and the need for the EU to reduce its dependency on imports.

The center-right European People’s Party (EPP) of the president remained the strongest group in the EU parliament after the June 6-9 elections. The success of conservative and far-right parties has raised concerns about how EU centrist politicians will be able to implement policies, such as 2030 climate change targets.

During a mining forum in Berlin in June, Wolfgang Niedermark, executive board member of the Federation of German Industries, made parallels between importing critical raw materials CRMs and importing energy.

"Our dependence on many mineral raw materials from China is already greater than it was for crude oil and natural gas from Russia," he emphasized. "We must protect ourselves from being blackmailed. And we must regain more control over the material that forms the basis of our economy and [the functioning] of our societies," he said, echoing Von Der Leyen’s words from her State of the Union speech in 2022.

The EU is due to meet only one of its targets by 2030 - in satisfying the 45% of domestic demand of magnet oxides. Turkey provides 98% of the EU’s supply of boron, used for glass, washing products, alloys, insecticides and fertilizers, while South Africa provides 71% of the EU’s needs for platinum.

Providing Recycled Material

European companies are positioning themselves to provide recycled materials as the demand for CMRs is set to increase.

MagREEsource, a spin-off from France's CNRS scientific research institute, aims to increase its recycling business effort. The company secured €5 million from PFR Poland, ArcelorMittal, and EIT RawMaterials for a recycling unit in Grenoble, targeting production by mid-2025.

The UK’s HyProMag is another academic-driven startup, based on research from professors at the University of Birmingham, developing technology to extract CRMs from recycling processes. Its patented technology extracts neodymium alloy powders from magnets embedded in scrap and redundant equipment.

The company established a German subsidiary to commercialize this technology in the EU.

Declining Mining Capex

The continent’s recycling business may be helped by European policymakers' aversion to mining. The EU plans for only 10% of supplies for CRM to be met through EU mining extraction.

Capital expenditures in European mining have declined due to a decrease in coal use. A century ago, Europe accounted for around 40% of global mining output, while now it stands at about 3%.

Europe’s struggle to renew this sector is becoming an obstacle to strengthening its industrial supply chain. Serbia is a notable example of a European country that has attracted significant investments in the mining sector.

The Chinese Zijin Mining Group committed €2.3 billion to copper mining operations, while multinational giant Rio Tinto has revived its €3.36 billion Jadar lithium project—the largest lithium operation in Europe.

Deep-Sea Mining Option

Another potential solution to Europe's CRM shortage is deep-sea mining. Norway recently discovered the continent's largest deposit of rare earth metals, significantly boosting Europe's supply.

Still, deep-sea mining is fraught with challenges, including the unknown environmental impact and the need for comprehensive regulations. The International Seabed Authority (ISA) will establish these regulations by 2025.

Notable companies to potentially benefit from this trend include:

GSR – a subsidiary of DEME (EBR: DEME), a €4.23 billion publicly traded dredging, environmental and marine engineering company.

Adepth – a Norwegian company specializing in advanced exploration of deep-sea metals.

Scandinavian Ocean Minerals – a harvester of ocean resources with projects in the Bothnian Bay and the Baltic Sea.

The future of deep-sea mining may hinge on the ISA leadership election. The current Secretary-General, Michael Lodge, who is pro-sea mining, is seeking a third term this July. He faces opposition from Leticia Carvalho, a Brazilian marine scientist with a more environmentally friendly stance.

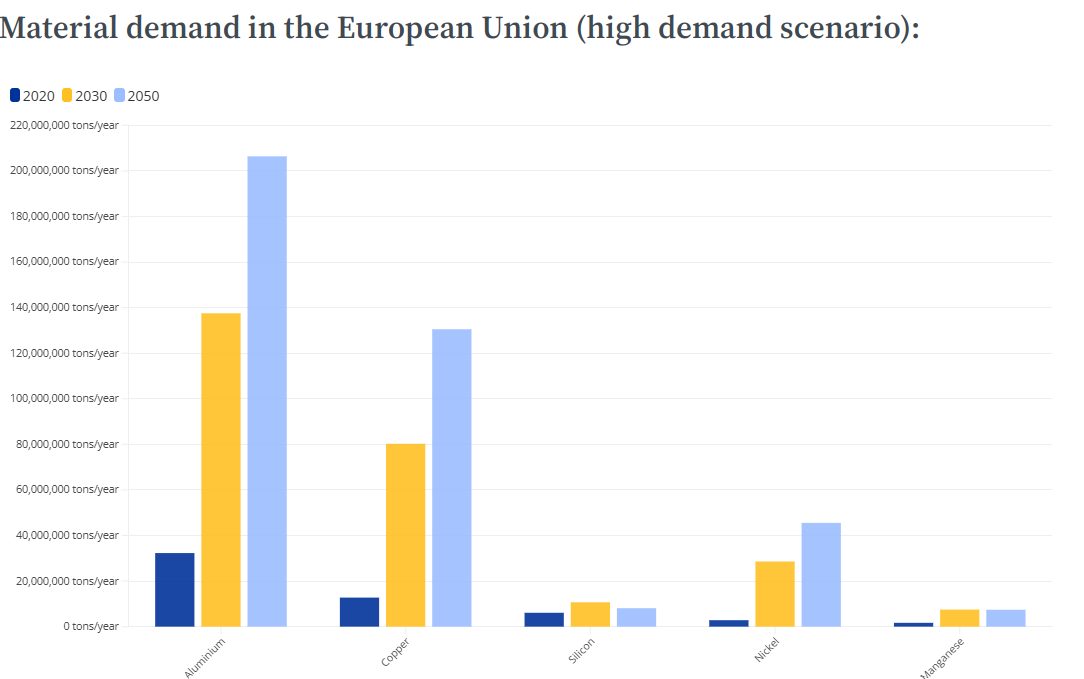

As global demand for critical minerals like cobalt, nickel, copper, and manganese grows, Europe must explore all viable options to secure its supply chain. Europe will need to turn to alternative supply chains, either through recycling or deep-sea mining, to meet a rise in demand for CRMs.

(Updates details about Scandinavian Ocean Minerals)

Thanks for mentioning Scandinavian Ocean Minerals but we are not a deepsea mining company. Our planed operations will take place in rather shallow waters, at 60 -120 meters depth. Also in an environmental habitat that is well known.

It does not make our project less interesting, contrary! With our method to harvest the minerals in form of sperical nodules in the Bothnia Bay, or oxygen free sediments in the Baltic Sea that is the cause of the eutrophication, we oxygenate the sea floor at the same time.

Please read more about us at www.som-ab.se

Peter Lindberg

CEO

Scandinavian Ocean Minerals