Copper Prices Hit Record High as EU Needs More Metal

Aurubis AG, Glencore well positioned to gain from higher copper prices

Copper prices have climbed to a record high this year as worldwide demand for the strategic metal intensifies at a time when the European Union (EU) will require greater volumes of the commodity for the electrification of its economy.

Globally, a combination of technological, geopolitical, and economic factors has started a commodities bull market that will see copper prices hit $12,000 a ton by the end of 2024, Goldman Sachs said in a report. Expectations for future price gains led to the first-ever spike over $11,000 a ton on the London Metals Exchange on May 20.

“We continue to forecast a shift into open-ended and mounting metal deficits from 2024 onwards,” Goldman analysts wrote in a note on May 7. There’s potential for a “stockout episode” in which inventories run extremely low by the fourth quarter, they said.

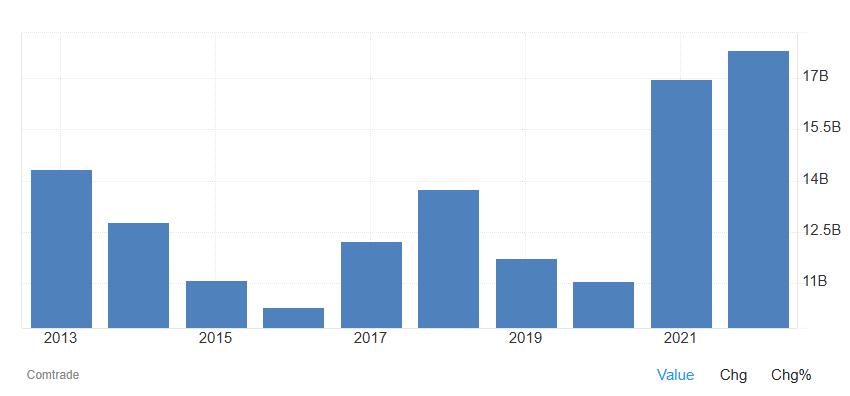

Copper has climbed 16.75% year-to-date, compared with 1.05% annual growth in 2023, as the world’s miners struggle to match growing demand.

Codelco, the Chilean state company battling to retain the world’s largest copper supplier title, suffered a series of setbacks at mines and projects this year, with production slumping to the lowest in a quarter century. Global supplies also declined after the Cobre Mine in Panama, accounting for 1% of worldwide output, closed in December.

EU’s Copper Demand

For the EU, higher copper prices will challenge the rollout of its electrification plans across the continent, spurred on by the expansion of data centers and electrification in transport, industrial processes, and buildings.

EU copper demand is expected to increase by 35% by 2050, with recycled copper meeting about 50% of required supplies, according to the International Copper Study Group. The European Commission has defined copper as a strategic raw material, indispensable for achieving its objective of a carbon-neutral economy by 2050.

Germany has significant copper production capacity and refining capabilities and globally ranked second in copper exports in 2023 behind Chile, totaling $29.03 billion, as well as a large secondary copper production capacity from refining copper scrap.

Closing the Gap

Copper miners, including those in Europe, will need to be incentivized to invest if they are to deliver sufficient supplies to close “the theoretical supply gap” that could emerge in the next decade, according to a Wood Mackenzie report from March. Between 2020 and 2050, the EU will need to invest about €12.5 billion to meet demand, according to the European Copper Institute.

However, increasing production capacity is a difficult long-term commitment and often involves geopolitical risks outside the bloc. Goldman noted that investment in new commodity production capacity has been low since the mid-2010s, due to the poor returns generated over the previous decade and the increases in the cost of capital driven by environmental concerns.

In the EU, high energy prices, complex regulatory frameworks and long permitting processes for mining and processing projects make the bloc a difficult place to invest, according to the European Copper Institute.

The Panamanian Supreme Court’s decision to close the Cobre mine last year highlights the risk to international investors developing copper mines. The court overruled a March 2023 contract awarded to First Quantum’s local subsidiary Cobre Panama to continue operating the mine for at least 20 more years.

Vancouver-based First Quantum’s share price has dropped 45% during the past year. It is up 43% year-to-date.

Aurubis, Glencore to Gain

Aurubis AG (NDA.DE), one of the leaders in copper production and the biggest copper recycler worldwide, has been actively diversifying its copper imports to reduce dependence on Chile and Peru, a move that may allow the company to capture a larger portion of the growth in copper demand.

The company is pursuing a growth strategy with investments totaling around €1.7 billion, according to its first-half 2023/24 results, and is on track to extend its operations in the U.S. with a “first-of-its-kind” $700 million copper recycling facility in Georgia to ramp up capacity to 180,000 metric tons.

Switzerland-based Glencore (GLEN.L) is another company with a significant advantage due to its integrated operations across the supply chain, which include copper recycling services.

The company has invested in recycling technologies and facilities, positioning itself to benefit from growing demand and its sustainability appeal, and is expected to generate approximately $1 billion in the next five years from battery recycling alone, according to UBS.

Recycling production represented 5% of the company’s third-quarter 2023 production, but this is expected to increase and drive profitability higher as the company expands its recycling operations due to the lower cost structure.

Demand for resources, such as copper, is expected to increase exponentially in the coming years, not just in the EU but worldwide, according to a May 23 article by The Conversation, a publisher of research-based news and analysis. This will increase global competition just as the EU’s own needs soar, it said.

“Against this backdrop, preparedness is crucial,” the publication wrote.