British Vote on Economic Dissatisfaction in Historic Election

Poll shows that 78% of the public thinks economy is in poor shape

Millions of British voters head to the polls today to choose different policies on taxation, fiscal spending, healthcare and immigration after the country’s Prime Minister Rishi Sunak called for earlier elections in May, a move that looks likely to end 14 years of Conservative rule.

Most of the polls point to the opposition Labour Party having about a 20-point lead on its main rival, the Conservatives. Labour is on track to win around 40% of the vote while roughly 20% of the support is projected to go to the Tories, according to a Sky News poll tracker.

The elections will take place against a backdrop of dissatisfaction among the British public about the health of the economy. A survey published on June 20 by the Pew Research Center showed that 78% of those polled said the economy was in poor shape.

“Britons are more negative about their country’s economy than people in most of the other countries we surveyed this year,” the Pew Research Center said. None of the four major British political parties – the Labour Party, the Liberal Democrats, the Conservative Party and Reform UK – in the survey of 1,017 British adults received net positive ratings, the center said.

In neighboring France and Holland, voters turned right in response to slow economic growth and concerns about immigration. During the first round of France’s snap national elections on June 30, the far-right National Rally party took the lead. The second round is on July 7.

Three Conservative PMs

In the United Kingdom, voters are turning away from the conservative party after three prime ministers since Boris Johnson won by a landslide in the 2019 general election. Then, the Labour Party suffered its worst defeat since 1935. It has since rebuilt itself under the leadership of Keir Starmer.

Labour is now projected to win 428 seats, giving the party a majority of 102. The Conservatives are expected to fall to just 127 seats, and some polls question whether they will even reach three figures.

Nigel Farage's Reform UK is forecast to win seven seats, according to the Survation research, amid mounting frustration with the country’s immigration policies. Farage, the most well-known champion of Brexit, announced his return to politics to lead the hard-right Reform UK party.

About 47 million people are eligible to vote in this election in 650 constituencies across England, Wales, Scotland, and Northern Ireland. A party needs 326 seats to form a majority government.

Diverging Policies

Sunak and Keir have campaigned on different economic remedies in a bid to win over wavering voters. In their first televised debate in June, they clashed over Britain’s economic fortunes, taxes, immigration and the state of the National Health Service.

Sunak, who took office in October 2022, has proposed tax cuts for the self-employed and a return to an era of mandatory national service for young people. Kier has proposed an increase in public spending and higher taxes on corporations, a development that has businesses and investors watching.

On immigration, Conservatives want to focus on enforcement and deterrence. They argue that the Illegal Migration Act and the policy of sending illegal immigrants to Rwanda will deter people from coming to the UK to claim asylum.

Labour wants to spend money currently earmarked for the Rwanda scheme on enforcement activity instead. It would establish a new ‘Border Security Command’ to prosecute gangs operating small boat routes and enhance security cooperation with the EU.

Labour also plans to increase funding for the National Health Services (NHS). Conservative policies may focus on private sector involvement and efficiency measures after Sunak promised to cut NHS waiting lists.

Economic Pain

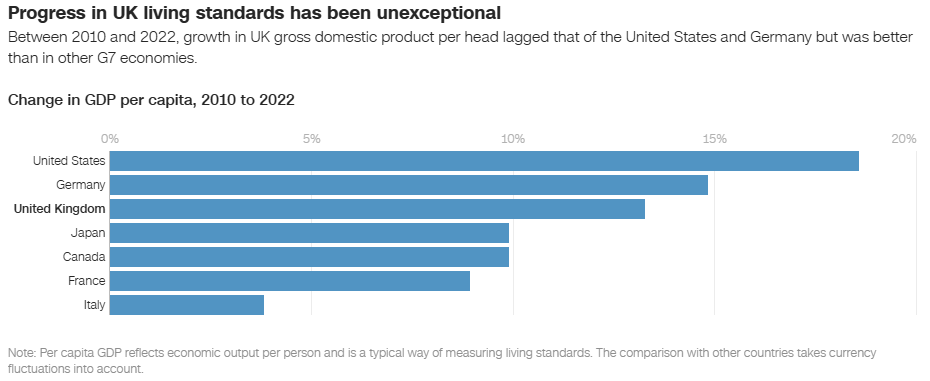

Although the country has made headway on inflation and rebounded from a mild recession, it has long-standing problems, such as ailing labor productivity, S&P Global wrote on June 26. GDP grew 0.6% in the first quarter of 2024, following two successive quarters of contraction, according to the country's Office for National Statistics.

Income growth has also slowed.

Median incomes grew by only 6% between 2009–10 and 2022–23, according to an IFS research report published on May 31. Before the Great Recession, an economic recession that was precipitated in the US by the financial crisis of 2007–08, median income growth was expected at about 30% in a 13-year period, it said.

“Poor income growth has been an unfortunate feature of economic life in the UK over the last 15 years,” Tom Waters, an author of the report and an Associate Director at IFS, said. “The UK has fallen from being one of the fastest growers prior to the Great Recession, to one of the weakest performers.”

Brexit also remains a drag on the economy.

“Brexit led to a large and long-lasting increase in uncertainty,” Clare Lombardelli, deputy governor for monetary policy at the Bank of England, said in a questionnaire on the central bank’s website. “The data also show that Brexit has had a negative effect on trade.”

FTSE-250 Reaction

The FTSE 250 has generated positive performance in seven of eight UK elections during the preceding six-month period. During the four most recent elections, the FTSE 250 delivered an average return of almost 11%, according to RBC Capital Markets research.

In the weeks and months after an election, the strongest average industry outperformers have historically been real estate, utilities, and industrial goods and services, according to RBC Capital Markets. Consumer staples and basic resources tend to gain more momentum at the three-month and six-month mark, it said.

Since Sunak called for the snap elections on May 22, the FTSE 250 has declined about 1%.

In France, stocks rallied on July 1 after results from the first round of elections suggested the far right would defeat President Emmanuel Macron, but fall short of winning an outright majority in parliament. France’s CAC 40 index closed 1% higher on the day, and is up 1% year-to-date.

A Labour victory could lead to short-term market volatility due to uncertainties about their economic policies. If the Conservatives retain power, markets may react positively in the short term due to policy continuity, while a hung parliament could lead to prolonged uncertainty and potential market inactivity.

The outlier in the UK election is Farage’s Reform UK party. While polled to take only seven seats, winning more would add uncertainty to British markets.