France Loses Niger Uranium Mine as EU, Trump Boost Nuclear for AI

Uranium prices surged after a sluggish start to the year, with spot prices climbing over 11% in June to $79.70 per pound

France, Europe’s largest producer of nuclear energy, has lost control over a significant uranium reserve in Niger after the African country’s military junta nationalized the Somair mine.

The junta described the move as a step toward “healthier and more sustainable management” of national resources. French state-owned company Orano SA had operated the mine for 55 years.

Niger ranked among the world’s top 10 uranium-rich nations, holding 6.2% of global reserves as of 2023, according to the World Nuclear Association. Niger's uranium has fueled over 30% of France’s nuclear reactors, making the seizure of Somair a strategic setback for Paris.

Besides Niger, the latest commodity cycle (a period of sustained price increases which started with gold surging above $2,400 per ounce in early 2024) has driven other regional governments to pressure foreign producers to surrender a higher percentage of royalty payments.

In Mali, the governing junta placed Barrick Mining’s Loulo-Gounkoto complex under state administration. The government has halted production at the complex, which produces over 600,000 ounces of gold annually, since January over a tax dispute. Meanwhile, the junta claimed it had secured over €1 billion in additional revenue by renegotiating mining contracts.

This pattern of abrupt regulatory changes, seen across Mali, Burkina Faso, and Niger, has weakened the influence of France and Europe in the Sahel region. Russia and Turkey have expanded their ties in the region on the back of anti-Western sentiment driven by military coups in Mali, Burkina Faso, and Niger since 2020 amid weak governance, corruption, and inability to address security threats.

As Western mining companies reassess their presence, nations such as Côte d’Ivoire and Namibia may gain in importance as uranium hubs.

US Policies Revive Uranium Market

Meanwhile, Uranium prices surged after a sluggish start to the year, with spot prices climbing over 11% in June to $79.70 per pound. After bottoming on April 8, Sprott Junior Uranium ETF (URNJ) rose by 74%, driven by renewed investor confidence and robust demand fundamentals.

Washington policymakers have provided significant tailwinds. On May 23, 2President Donald Trump signed four executive orders invoking the Defense Production Act to accelerate domestic uranium production, enrichment, and fuel cycle infrastructure.

Trump's executive orders aim to quadruple US nuclear power capacity from 100 GW to 400 GW by 2050. This would raise annual uranium demand from 50 million pounds to 200 million pounds U₃O₈, nearly double the 164 million pounds forecasted global mine production for 2025, according to UxC.

AI data centers are also becoming major energy consumers. Meta’s recent 1.121 MW nuclear power deal with Constellation Energy shows the scope of such requests. This combination of industrial and geopolitical momentum is positioning uranium as a cornerstone solution for the ever-growing energy demand.

After stagnating for two decades, EIA expects the U.S. power consumption to reach record highs in 2025 and 2026. This will support regional power-related companies, such as Cameco (NYSE: CCJ), Vistra (NYSE: VST), and GE Vernova (NYSE: GEV).

EU Commits €241 Billion to Nuclear Expansion

Like the US, the European Union (EU) has implemented policies to expand nuclear production.

The European Commission has estimated that increasing the EU's nuclear capacity from 98 GW to 109 GW by 2050 will require a cumulative investment of €241 billion, according to its draft investment roadmap issued on June 13. This amount encompasses €205 billion for the development of new reactors and €36 billion for the life extension of existing infrastructure.

Nuclear power currently supplies 23.7% of the EU’s electricity. Twelve of the EU’s 27 member states operate nuclear reactors, with France's 56 reactors accounting for approximately 70% of the EU's nuclear capacity.

The plan has acknowledged the risks of delay: a five-year lag in new builds could result in increased costs of €45 billion. Rapid data center expansion is already straining the power grids of EU countries and limiting the potential for AI expansion.

Ireland’s data centers are expected to consume 30% of the country’s electricity by 2030.

Western Europe Sees Nuclear Power Reassessed

To mitigate investor risk, the EU and European Investment Bank plan to launch a €500 million pilot program for power purchase agreements, with nuclear projects eligible. The Commission pointed out that “a combination of diverse sources of financing complemented by de-risking instruments may be the response.”

Recent political shifts support this transition. Following the shutdown of its last three nuclear reactors in 2023, Germany changed its stance and stopped hindering the inclusion of nuclear energy in the EU's green energy initiatives. Denmark and Spain are also reevaluating their positions on nuclear energy, prompted by concerns over energy security and recent grid disruptions.

These actions reflect a significant recalibration across Europe: nuclear energy is now being reassessed not only as clean but also as crucial.

"We know that it's a low-carbon energy source, which means we can meet our European climate targets, but it's also an abundant energy source," Belgium's Energy Minister Mathieu Bihet said.

Urenco Group, a uranium-enrichment company majority-owned by the governments of the Netherlands and the UK, is among the companies well-positioned to benefit from this market shift.

Sweden’s Viken Deposit: A Potential Uranium Game-Changer in Europe

The Swedish Ministry of Climate and Enterprise proposed on June 12 to lift the country's uranium mining ban. If the parliament ratifies this policy shift in the third or fourth quarter of 2025, uranium will be classified as a concession mineral under the Minerals Act, effective January 1, 2026.

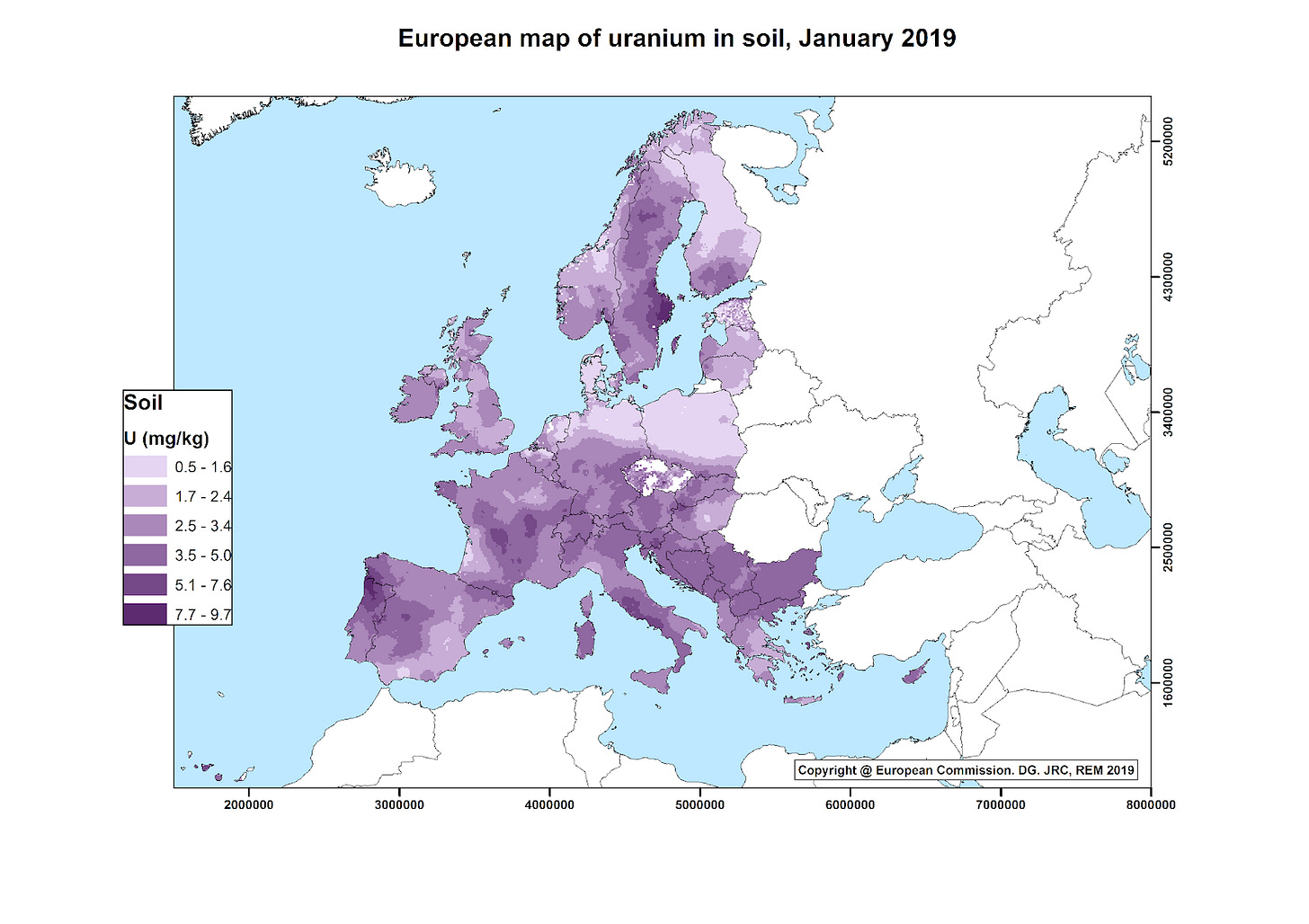

The Canadian mining company District Metals Corp (DMXCF: OTCQB) would benefit from this policy change, as its Viken Property in central Sweden has 43,500 tons (95.9 million pounds) of U₃O₈. According to the company's filings and independent assessments, this deposit represents more than 80% of Europe’s known uranium resources.

Alongside uranium, the deposit includes major quantities of vanadium (312 million pounds), molybdenum (144 million pounds), and nickel (98 million pounds), offering broad strategic resource potential.

“The Swedish Government’s consistent and rigorous approach toward lifting the uranium moratorium appears to be advancing… Sweden is poised to unlock its vast uranium resources for the green energy transition during a time of increasing geopolitical unrest,” CEO Garrett Ainsworth said in the latest statement.

The firm has commenced an airborne MobileMT geophysical survey. It updated the Viken resource model as of April 2025, guaranteeing readiness for permitting and future production once the moratorium is lifted.

Sweden's foray into uranium production could potentially mitigate Europe's supply risks following disruptions in Niger and the tense relations with Russia, which accounts for over 20% of the EU's enriched uranium supply.